Battery electric mining vehicles (BEVs) have been commercially available and working in the underground mining industry for well over a decade now. Introduction globally has been led by early adopter Canadian miners – Agnico Eagle Mines Limited, Goldcorp (now Discovery Silver), Glencore Integrated Nickel Operations, Vale North Atlantic, and Torex Gold.

MacLean has been at the forefront of this battery electrification of underground mining since the launch of our full-fleet electrification program in 2015. Over the past decade, we have electrified almost our entire product line and shipped over 100 BEVs to sites in North America, Africa, and Australia, amassing 500,000+ operating hours along the way. What’s more, frontline learnings have been integrated along the way that in turn have fueled further product development. ‘EV-proven, EV-ready’ is more than a slogan, it’s a statement of fact borne out of years of experience in the real underground environment. Simply put, for mining companies around the globe looking to decarbonize their operations, we have an option that is commercially tested and ready to work.

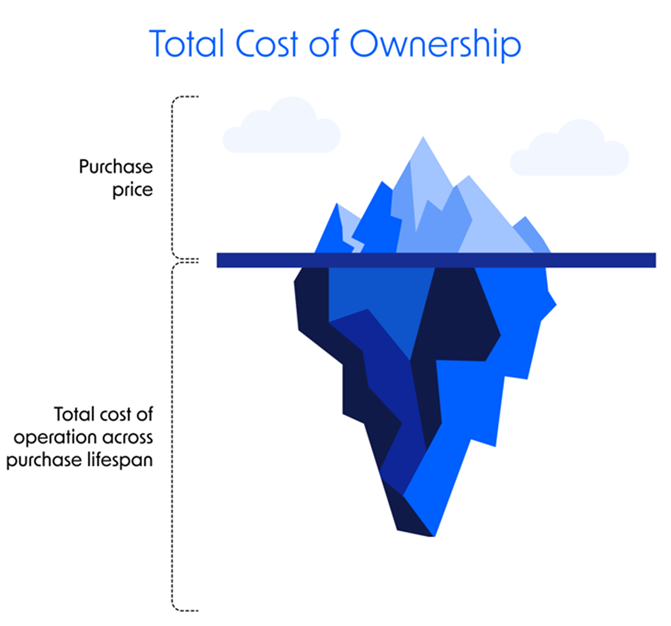

Often, the first question we get asked when customers approach us with an interest in exploring diesel-free fleet options, revolves around costs. And the good news is, all this experience that MacLean has accumulated over the years in designing, manufacturing, and supporting BEV mining trucks in the field, has also allowed us to build an accurate cost profile, what is referred to in the industry as TCOs – the Total Cost of Ownership. This metric captures the comprehensive mobile unit cost profile, from the initial capital investment to ongoing maintenance costs throughout the product, to indirect costs or indirect savings such as ventilation and tax credits.

Working with one of our longstanding customer partners, MacLean product management and engineering staff were able to compile a thorough and comparable cost profile of MacLean BEV versus diesel units, primarily in the area of maintenance costs, which account for the large majority of the Total Cost of Ownership dollar amount. And long story short, after this deep analysis based on real-world BEV and diesel fleet performance, the maintenance cost portion of the Total Cost of Ownership was basically equivalent when comparing battery powered to diesel units. But where the BEV units outperformed were in the areas of machine availability and in indirect costs categories, most notably: energy costs (operations and ventilation) where BEVs delivered 25% lower costs than their diesel counterparts.

The big picture is this. With BEVs you get thousands of tonnes of CO2 elimination per rig per year, a significant reduction in energy requirement for operating power and associated ventilation, plus workplace environment benefits of reduced noise and improved air quality, in addition to improvements in availability due to maintenance efficiencies.

So, even though full picture of the true ‘total’ cost of ownership BEV vs. diesel nets out essentially equal, what really tips the balance in favour of the BEV option is those broader, indirect benefits of helping companies meet their decarbonization targets while also improving the work environment for their workers and doing it all for…the same cost as a diesel fleet! The simple question becomes, for equal costs but with a whole array of important indirect benefits, why wouldn’t you make the EV switch?

Please reach out to us for more detailed information. We’re here to help with every step of your fleet electrification process, from EV mine planning to duty cycle modelling to procurement to commissioning and training to field support.

Email us at: info@macleanengineering.com

The product is there, the data is there, the field experience is there, and the opportunity awaits

Together, towards a greener future.